Microcredit: the tarnished Nobel medal

Grameen Bank’s microcredit model has earned prestigious plaudits. But did it reduce poverty and create profitable businesses?

“Poverty will be eradicated in a generation. Our children will have to go to a ‘poverty museum’ to see what all the fuss was about.”

Thus declared Muhammad Yunus, a professor in rural economics at Chittagong University in south-eastern Bangladesh, when he pioneered a new credit model for the poor in a nearby village, Jobra, in the late 1970s. He called it the Grameen Bank Project, a name derived from the Bengali word for “rural village”.

Thirty years later the Nobel committee awarded its 2006 peace prize to Mr Yunus and his bank. The citation recognised that “loans to poor people without any financial security had appeared to be an impossible idea”, but that Mr Yunus had “developed microcredit into an ever more important instrument in the struggle against poverty”.

Grameen sidestepped traditional credit models, which considered it imprudent to extend small loans to the poor because they lack reliable income and assets as collateral. The only recourse for poor borrowers had been moneylenders who charged high fees and interest rates to justify the high risk of non-repayment.

Mr Yunus wanted to eliminate this perceived exploitation and break the vicious cycle that low income and low savings implied low investment. He built his concept on the notion that the poor possess skills that can be capitalised. His project sought promising borrowers who had no financial means but would have the potential to generate income through self-employment.

Grameen would issue simple loans at very low rates. Risk was reduced by selecting groups of borrowers and making them jointly liable to meet their repayment commitments. The hope was that borrower groups in this collectivist model would exert peer pressure to encourage productive use of loans and reduce default risk. This would lower institutional lending costs and interest to borrowers.

The bank explicitly pitched itself as a way of “bringing capitalism down to the poor”, according to Milford Bateman, an independent development consultant. This approach secured it lavish support from the international development community, he wrote in Le Monde Diplomatique in November 2012. Led by the Ford Foundation, funders were lining up to back what appeared to be a credible alternative in the small- scale development finance sector.

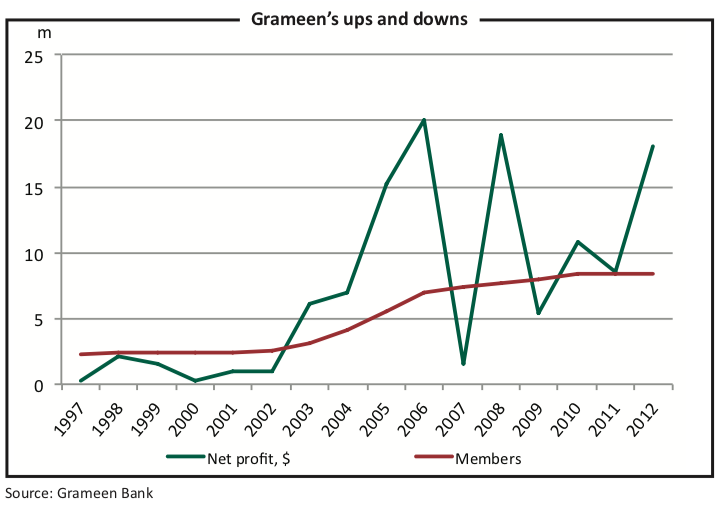

By 1996 the bank had issued $1.7 billion in loans to 434,000 groups comprising more than 2m individuals, 94% of whom were women, according to the bank. It boasted repayment rates of 98%. It made a modest profit of $460,000 that year.

This seemed to be a fairy tale come true. By the late 1990s the microcredit model was the most high-profile and well-funded of all international development policies, according to Mr Bateman.

Shahidur Khandker, lead economist at the World Bank’s rural development team, found Grameen-style microcredit effective in reducing poverty among people who can become self-employed, and more cost-effective than other anti-poverty projects.

Not everyone agreed, however. As early as 1995, the libertarian economist Jeffrey Tucker described microcredit as a cult. “A closer look…shows the movement to be financially dangerous, subtly coercive, and, in its most famous case, an enemy to children and families,” he wrote in an editorial for The Free Market, a publication of the Ludwig von Mises Institute, a US-based think-tank.

He noted the strong social pressure and indoctrination that the bank imposes on its mostly female borrowers, including vows to maintain small families, “emancipate” themselves from traditional marriage obligations, engage in subsistence farming and collectively participate in physical training exercises and parades.

Jonathan Morduch, while a lecturer at Princeton University, published a paper in 1999 on the Grameen Bank in the Journal for Development Economics. Despite reporting a profit, the bank is extensively subsidised, Mr Morduch found. At first, mostly international donor organisations backed the bank, but later, guaranteed Bangladeshi central bank bonds and soft loans from developed countries funded Grameen. Between 1985 and 1996, subsidies amounted to $175m, compared to a cumulative profit of less than $1.5m.

Although it is not dishonest to declare a profit after receiving subventions, Mr Morduch also revealed that the bank’s profitability in some years is an artefact of accounting methods that “do not conform strictly to international accounting standards”. The bank remains “constrained by high expenses per unit transacted and relies on the generosity of donors and socially-conscious investors”, he wrote. “Microfinance programmes that target the poorest borrowers generate revenues sufficient to cover just 70% of their full cost.”

The Grameen model is not financially sustainable, argued Jacob Yaron, a World Bank research economist, in a 2004 paper for the bank’s journal, Research Observer. “Because of high risks, heavy transaction costs, and mounting loan losses, many of the programmes have drained state resources to little purpose, reaching only a small part of the rural population and making little progress towards self-sustainability,” he wrote.

The Grameen Bank itself recognised the problem, according to Mr Bateman. World Bank indicators show that poverty rates in Bangladesh continued to rise, from 36% in 1995 to 45% in 2004. In 2002 the bank launched Grameen II, which sought to add revenue-generating product lines such as deposit services and more flexible business loans to the core microlending business, but also increased credit costs for borrowers.

Awarding the Nobel Peace Prize in 2006 to Mr Yunus and Grameen Bank varnished over the cracks in the microcredit story. The international donor community loved the “non-state, self-help, fiscally responsible and individual entrepreneurship angles”, Mr Bateman said.

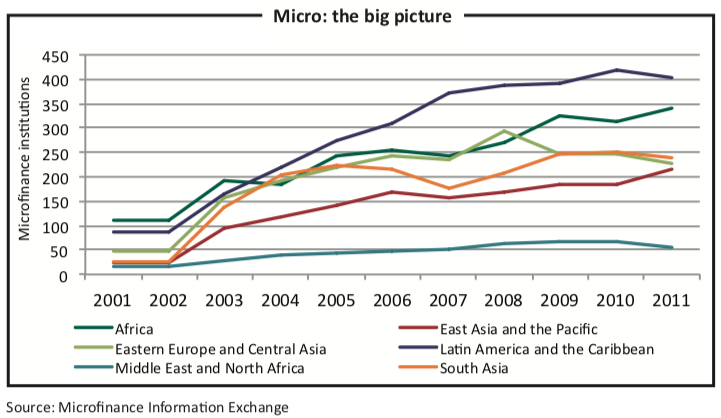

Replication was the order of the day, with more than 3,000 imitations globally, and wide popularity among development finance theorists, wrote Naiefa Rashied of the University of Johannesburg’s economics department in a 2010 piece in the African Finance Journal.

Despite its perceived success, the varnish crackled. For example, a 2008 Kellogg School of Management study found that the Grameen model had failed in South Africa. The analysis blamed laws that imposed affordability criteria on banks and lenders and therefore limited credit to borrowers who were formally employed. In addition, the dominant, protected and inefficient formal banking sector had little reason to seek new markets among the unbanked poor. Furthermore, many microcredit-funded enterprises were trying to produce goods and services that were already supplied by more efficient and established businesses in the formal sector.

A major failure of the Grameen model is that it distorts risk-taking, according to a 2013 paper in the Annual Review of Economics by Abhijit Banerjee, an economics professor at MIT. When lenders targeting the poor do not have an explicit charitable mission, or foreign donors or soft loans subsidise their lending capital, they operate in a low-risk environment protected by collective liability and garnishee orders (which re- quire an employer to pay debt instalments directly to creditors on behalf of employees). Such market distortions insulate lenders from the financial risks their borrowers take.

By 2009, Grameen Bank averaged over $10m in annual profit and served 8m people in 1.25m groups with loans totalling $8.7 billion. Profit remains volatile. In 2012 the bank reported $18.3m net profit, up from $8.6m in 2011. Membership growth has slowed, with 8.5m members in 1.32m groups reported in December 2013.

In Mr Bateman’s analysis, the failure of microcredit to alleviate poverty lies deeper than mere questions about financial sustainability. By dominating scarce resources to “churn out rafts of largely unsustainable and no-growth informal micro- enterprises and self-employment ventures”, microcredit crowds out ventures that really have the potential to innovate, scale efficiently and integrate into the economy.

In essence, the effect of Grameen-style microcredit is exactly the same as a small-business subsidy system. It creates what Mr Bateman calls a “hot-house” that benefits inefficient businesses that replicate existing ideas at the competitive expense of true entrepreneurs that grow the economy.

But Mr Bateman goes further, attacking the kinds of enterprises that are favoured, such as subsistence farming and basic crafts, rather than broader commercial and manufacturing industries. “Essentially, the problem is that the microcredit movement has built into the local financial system an ‘adverse selection’ bias, one that had inevitably led on everywhere to the gradual primitivisation, de-industrialisation and informalisation (sic) of the local economy,” he wrote. “In turn, this can only lead to the local community’s further descent into generalised poverty and underdevelopment.”

Mr Bateman is scathing about the failure of microcredit in South Africa. He argues that it has been the primary driver of household over-indebtedness. Nearly half of the country’s 19m credit-active consumers have impaired credit records. Another 15% are “debt-stressed”, or have missed one or two payments without being reported to the credit bureau. This means that nearly 65% of all credit-active consumers are over-indebted.

Another, more important factor, lies with institutions that rely on salaries as collateral, through garnishee orders. Nearly 95% of all so-called microcredit is little more than a salary-advance scheme, wrote Iniobong Akpan in his 2005 masters in commerce thesis for South Africa’s Rhodes University.

The uncritical replication of these microcredit policies has created widespread social and economic problems. For example, over-indebtedness, and the sentiment among workers that employers were collaborating with microlenders who instituted onerous garnishee orders, were widely reported to have contributed to the labour unrest that culminated in the police massacre of 34 striking workers at the Lonmin platinum mine in Marikana, South Africa in August 2012.

At the outset, Mr Yunus wanted to address traditional lenders’ exploitation of the poor. The problem is not only that this practice has now been cloaked in the Nobel- sanctified mantle of Grameen, but that it is far from clear that the Grameen model actually works, either for the lender or the borrowers.

More than three decades later, there is no evidence of a link between the Grameen Bank and the Bangladeshi poverty rate. The sustainability of this microcredit model for lenders is doubtful, without the help of subsidies. While anecdotal success stories exist, the broader impact on poor borrowers is variable.

Grameen survives largely through subsidies and grants, borrower indoctrination and by spreading default risk to rural communities. This results in gambles that are either too high or too low. Its returns are primitive, unproductive or failed businesses. And despite Mr Yunus’s confident prediction a generation ago, we do not need to visit a museum to see poverty.