Africa holds 60% of the world’s platinum deposits, more than 40% of the world’s gold and almost 90% of the world’s diamonds, not to mention substantial oil reserves that remain largely unexplored—yet it remains the world’s poorest continent, with 47% of the population living on less than $1.25 per day. No wonder there is a constant refrain in Africa: “If we are so rich, why are we so poor?” Terra Lawson-Remer and Joshua Greenstein examine how the global community can help Africa tackle the resource curse.

Many resource-rich African countries make poor use of their wealth. Take Equatorial Guinea, a small oil-producing country on the continent’s west coast. In 2010, an estimated 75% of the population lived on less than $700 a year, but the average per capita income was almost $35,000, the continent’s highest. Instead of creating prosperity, resources have too often fostered corruption, undermined inclusive economic growth, incited armed conflict and damaged the environment.

Corruption is endemic in many of Africa’s most resource-rich countries. Rather than invest resource revenues into infrastructure and education, crooked politicians, often in collusion with the companies mining the resources, siphon proceeds from the continent’s mineral and petroleum wealth into their own pockets.

Resource-rich countries are plagued by a phenomenon called “Dutch disease”. (The Economistcoined the term in 1977 to describe the impact of the North Sea gas bonanza on the economy of the Netherlands, whose exports of natural resources led to foreign exchange inflows which drove up the value of the currency. The overvalued currency made domestic manufacturing, agriculture, and other exports less competitive.) This illness afflicts both well-governed and poorly-governed countries, but the former have more ways of allaying the consequences.

Often countries with weak governance and abundant natural resources are prone to armed violence. For example, Sudan, where oil rents are equal to more than 18% of gross domestic product (GDP), and Nigeria, where oil rents amount to almost 30% of GDP, have been plagued by conflict.

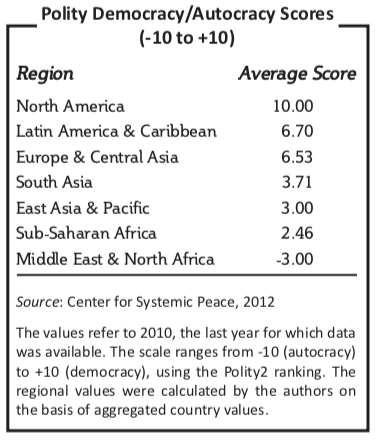

Natural resource dependence insulates leaders from public pressure and accountability. Troublingly, Freedom House rates only five of the world’s 20 top oil- producing countries as “free”. In many countries with significant natural resources, important checks on government power, such as a long democratic culture and a vociferous civil society, are in short supply.

In Africa, the top eight oil producers in 2011 were Nigeria, Algeria, Angola, Egypt, Libya, Sudan, the Republic of Congo and Equatorial Guinea. In the last decade, violent conflict or repressive regimes have plagued these countries. Every one for which a ranking is available has a negative score on the World Bank’s control of corruption index. Polity, a United States-based project which measures the authority characteristics of states, scores these countries from mediocre to awful.

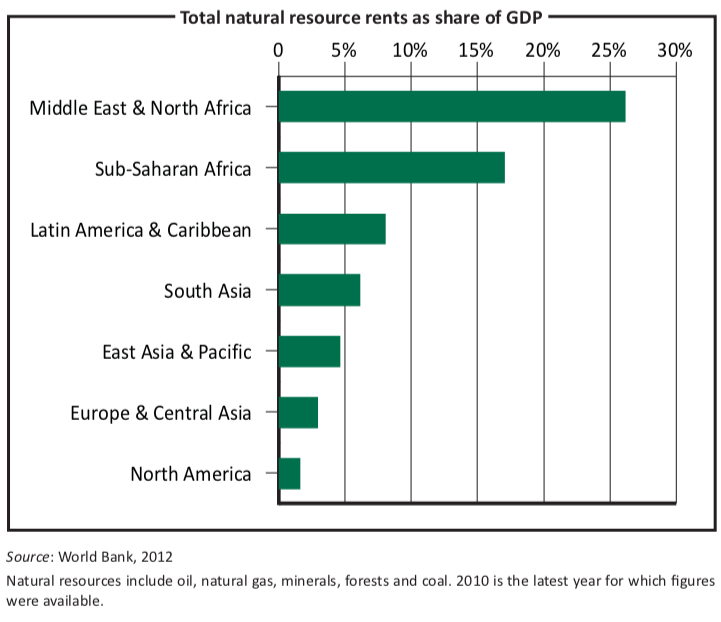

The mix of resource abundance and poor governance is especially lethal in resource-rich Africa. As a share of GDP, sub-Saharan African resource rents are higher than those of any other region in the world, according to the World Bank. Rents are defined as the difference between the value of production at world prices and the total cost of production for oil, natural gas, minerals, coal, and forests.

For example, the Republic of Congo has the highest total resource rents as percentage of GDP in Africa (64%) and one of the lowest control of corruption scores. Equatorial Guinea, with a government widely seen as autocratic, has the worst control of corruption score among African countries. It also has very high resource rents as a share of GDP, at 47%.

But resources do not automatically lead to poor outcomes. For instance, North America produces more oil than Africa, but it has the lowest resource rents as a share of GDP and has good governance ratings. Canada remains among the top ten world oil producers, according to the US Department of Energy, but has one of the least corrupt governments in the world, also according to the World Bank. Norway is one of the top ten exporters of crude oil in the world, while maintaining its stature as a perennial leader of the United Nations Human Development Index. The resource curse is avoidable.

Africa could be prosperous if it practised good governance: transparency in its dealings with mining, oil and gas companies; stronger disclosure and anti-corruption rules; and economic policies that promote diversified economies and discourage dependence on resource rents. Transnational companies could be compelled to play a more important role, too, by enforcing and strengthening existing transparency rules.

Governments in extracting and capital-exporting countries, bilateral donors, multilateral financial institutions, the extractive industry, private financial institutions, and civil society have made promising steps towards addressing the resource curse in recent years.

For example, the World Bank’s International Finance Corporation (IFC) stipulates the social, environmental, and governance requirements for all World Bank investments in private-sector projects. In 2011 the IFC made revisions that included strong improvements mandating contract and revenue transparency. However, the IFC rules do not affect bilateral loans. This loophole permits donor countries to continue lending money to companies that collude with unsavoury officials while keeping the terms of billion-dollar oil and mining deals secret from the public.

There have also been some signs of progress in the financial industry. The Equator Principles (EP) is a voluntary programme that requires borrowers to adhere to social and environmental standards before the participating banks will provide loans. Launched by ten banks in 2003, less than a decade later more than 70 banks are participating, covering more than 70% of project finance in emerging economies. However, there is no mechanism for determining if the borrowers and banks are actually adhering to the EP standards.

In 2010 the US Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act. It requires extractive industries that are listed on the US stock exchange to make public the type and amount of payments they make to governments. The European Commission also recently proposed transparency requirements that are in some respects stricter than Dodd-Frank. However, European Union (EU) member states and the EU parliament have yet to approve these measures, and the US Securities and Exchange Commission has so far stalled in issuing the final disclosure rules for companies. In the meantime, the industry campaigns to dilute or abandon the reforms.

The Open Government Partnership (OGP), launched in 2011, is another international action for more government transparency and accountability. The Extractive Industries Transparency International Initiative (EITI) pursues similar aims (see page 32).

Africa has made limited progress in ensuring more transparency. For example, Ghana last year established an accountability committee of political and business leaders. As reported in the Ghanaian Times in May 2012, the panel’s first report claimed to have found a major oil-related revenue stream that was either misdirected or not documented properly. The Revenue Watch Institute, a New York- based non-governmental organisation that promotes the transparent and accountable management of oil, gas and mineral resources, has long considered Ghana a country with poor transparency. These recent events may be cause for optimism.

Transparency alone, however, is not sufficient. Nigeria, for example, has joined EITI, yet the country is still widely viewed as corrupt by its people, according to World Bank indicators.

Taking the step from transparency to actual accountability requires a civil society with the skills and training for effective monitoring. The demand for these skills exceeds available funding. Bilateral donors, the multilateral banks and the private sector should support programmes to educate citizens in auditing, accounting and tracking of revenues and expenditures. If citizens do not have these analytical and technical skills, they cannot hold public officials accountable for spending resource revenues badly.

The G20 countries could immediately agree to apply the IFC’s updated extractive industry transparency requirements to all bilateral development loans, export credit agencies and sovereign risk guarantees. Stronger transparency standards would ensure that a greater portion of externally- funded projects in Africa are socially and environmentally responsible.

Countries that export private capital and have jurisdiction over leading stock exchanges such as the United Kingdom, Japan and India should apply more rigorous transparency and reporting standards. The internationalisation of these rules would make it difficult for companies to ignore the requirements, as companies would not want to delist from these stock exchanges. The extractive industry sector is concerned with competition. Internationalisation of these rules might also ease domestic pressure in the US against the Dodd-Frank requirements and industry pressure against reform in the EU.

Voluntary reporting initiatives in the financial industry can be strengthened and improved. The Equator Principles are an excellent start by the private sector to hold itself accountable, but the lack of monitoring to ensure compliance is troubling. Equator banks should establish an independent monitoring mechanism to ensure that the lenders and borrowers are doing what they purport.

The steps taken thus far to increase transparency are promising but woefully insufficient. Coordinated international action is needed. These reforms, while not a panacea, might help countries across Africa beat the resource curse and translate natural resource riches into sustainable and inclusive growth.