By Nontobeko Mtshali

They are dollars wrapped with care — money that is homebound to villages and towns across the globe sent by relatives who have migrated in pursuit of greener pastures or refuge. These remittances to developing countries are expected to reach $516 billion dollars next year, an increase from the $404 billion recorded in 2013, according to the IMF. Global remittances to Africa went from $19.5 billion in 2004 and tripled to $63.8 billion in 2014, according to the World Bank. In addition to supporting parents and helping to put siblings through college, remittances play a major role in the economies of many countries. In an estimate slightly above the IMF’s, Dilip Ratha, an economist and manager of the World Bank’s migration and remittances unit, said the $413 billion international migrants sent home to families and friends in developing countries in 2013 was three times larger than the $135 billion that went towards global development aid over the same period. “We endlessly debate and discuss about development aid, while we ignore remittances as small change,” Mr Ratha said last year.

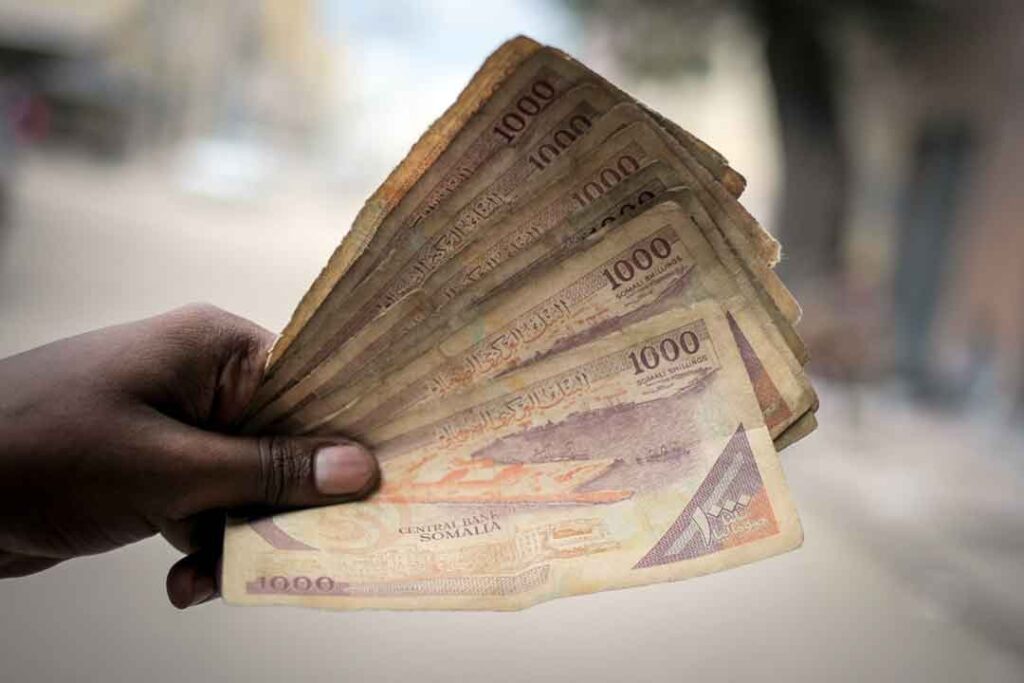

“True, people send $200 per month on average. But repeated month after month by millions of people, these sums of money add up to rivers of foreign currency.” Remittances to Egypt are three times larger than the revenue the government collects from the Suez Canal, Mr Ratha said. In poorer, fragile and conflict-ridden countries, remittances are “a lifeline”, he added. An example is Somalia, where they account for 35% of the country’s GDP. More governments in Africa are trying to harness this pool of funds by issuing diaspora bonds to pay for economic development. These bonds offer an alternative source of finance for countries that are too dependent on volatile commodities. Diaspora bonds have been around for decades. China and Japan were the first to issue them in the 1930s. But they came back in favour after the 2008 global recession, when aid to needy countries began to erode. The World Bank and the IMF started promoting diaspora bonds as an alternative source of capital to pay for development and costly infrastructure projects. Ethiopia was the first African country to issue a diaspora bond, in 2008.

“There have been regular bond issuances in African countries on the international market which were not restricted to a specific audience and could therefore be bought by the diaspora, for example, the Moroccan issuance in 2010 and Senegalese, Namibian, Nigerian and Zambian issuances in 2011 and 2012,” according to the African Development Bank (ADB). “For governments that have large diaspora populations, the bonds provide an opportunity to tap into a capital market beyond international investors, foreign direct investment or loans,” wrote Meiji Fatunla, then editor of a blog on the African Arguments news site. “If governments have experienced difficulties raising money on the international market or attracting investment, diaspora bonds can be an attractive new source of financing.” Many institutional investors may perceive investing in developing economies as a high-risk outlay, but expats may be savvier financiers because they know more about their homeland’s potential and pitfalls.

As a result, it may often cost governments less to borrow from their citizens who are living overseas, according to a 2010 report on diaspora investments by the Migration Policy Institute (MPI), a think-tank in Washington, DC. “This difference in risk perception can lead to a ‘patriotic discount’ on expected returns,” the MPI report found. This markdown was the difference between the market interest rate for government debt and the interest rate that expats are willing to accept. While the willingness of migrants to invest is not purely a financial decision, governments still need to ensure that their houses are in order before pulling on nationalist heartstrings. “Evidence suggests that patriotic discounts are particularly meaningful among first-generation immigrants and when the country of origin faces an external threat” such as a foreign invasion, according to the MPI report. But succeeding generations are less likely to invest, the report warned. “In countries where capital markets are less developed, such as in much of Africa and Central America … diasporas might play the role of ‘first movers’ and contribute to innovation and price discovery as well as to scale.”

First-generation diasporas may be more interested in direct investment and may be more prone to patriotic discounts, while second and higher generation diasporas may find portfolio investment a more accessible and less time-intensive approach, the report says. However, all members of the diaspora, regardless of age, are “less forgiving when their countries of origin face financial challenges due to domestic mismanagement”, it concludes. Ethiopia learnt this lesson the hard way. Its first diaspora bond, issued in 2008, was intended to finance a hydroelectric project for the Ethiopian Electric Power Corporation, but failed to meet its funding target. The state has been tight-lipped over how much it intended to raise and how much funding it managed to attract. It only conceded that sales were slow. The bond failed to meet its revenue goal because of a “lack of trust in the ability of the utility to service the debt, the full faith and credit guarantee of the government and the overall political climate in Ethiopia”, said ADB analysts Seliatou Kayode-Anglade and Nana Spio-Garbrah, in a 2012 brief.

This did not stop the country from issuing another diaspora bond in 2011 to finance the Grand Renaissance Dam, under construction on the Blue Nile near the Sudan border. It is set to be Africa’s largest hydroelectric dam but information on the amount raised so far through the diaspora bond for this $4.8 billion project has not been released. According to media reports, however, 80% of the funding was sourced from local taxes and the remaining 20% from treasury bonds. Ethiopians abroad and at home contributed the project’s first $350m and government workers donated amounts equivalent to a month of their salaries, according to Africa Renewal, a UN publication. More recently, Nigeria and Zimbabwe have also hopped onto the bond bandwagon. In March this year the Nigerian Senate approved outgoing President Goodluck Jonathan’s request to increase the revenue target of the country’s diaspora bond from $100m to $300m.

Raising the bond to $300m was needed to compensate for Nigeria’s dwindling oil revenues as oil prices have plummeted, said Ehigie Uzamere, head of a Senate committee that recommended the increase, according to This Day newspaper. The $100m diaspora bond in the 2012-2014 borrowing plan was too small considering the number of Nigerians living abroad, he added. Estimates of Nigerians living abroad range from 5m to 15m, according to www.nigeriandiaspora.com, a research site. Patrick Chinamasa, Zimbabwe’s finance minister, reportedly told Parliament last June that he was considering raising funds through diaspora bonds to pay for some of the country’s small hydroelectric schemes. According to a World Bank official, over 3m Zimbabweans are estimated to have left the country since 2000, mostly to escape the country’s socioeconomic decline and political troubles. Countries need to do their homework before issuing diaspora bonds, the ADB analysts Madam Kayode-Anglade and Madam Spio-Garbrah advise.

Relying on a country’s emigration figures is not enough, they warn. They need to look at education levels, income, how communities save their money and investment patterns, among other factors. The issuing country may need to conduct surveys in each destination country after determining countries or regions to target, they said in their brief. Ultimately, trust is critical to determining the success of a diaspora bond. “Good governance, transparency and political stability are the foundations of success,” wrote the ADB analysts. “Investors resident abroad, given their distance and in some cases, the underlying reason for their departure from the home country, must feel that the government has the capacity and goodwill to manage proceeds properly.”