Taiwan is an also-ran in the derby for Africa

by Richard Poplak

In geopolitics, as in a Saturday at the track, sometimes you back the wrong horse. Consider the case of the Republic of China (ROC aka Taiwan) and the Republic of South Africa, circa the 1970s and ‘80s. Those were the good old days, when the apartheid regime, the pre-democratic Taiwanese government and Israel formed a cosy nuclear troika, trading technology, know-how and materiel.

In 1980 Taiwan agreed to send South Africa over 4,000 tonnes of uranium for a weapons program designed to make the Cubans in Angola think twice. By 1987, Taiwan had over $100m staked in the South African economy. Trade between the two nations totalled $997m—a 67% jump on the previous year. Taipei, Taiwan’s capital, pumped cash into private ventures in South Africa’s Bantustans in the late 80s, a move that likely would have made even Margaret Thatcher blanche.

When apartheid teetered and fell, there was no possible way for this relationship to end well. And yet, it took several years for the affair to sour properly. Even then, it could have been worse. When the African National Congress (ANC) won the first democratic elections in 1994, the party was buoyed by wave after wave of lofty human rights rhetoric, and a constitution that brought tears to the eyes of even the toughest apparatchik.

South Africa was reluctant to drop trading partners given the state of its finances. The move from the ROC, itself a nascent, noisy democracy in 1994, to the People’s Republic of China (PRC), a country that routinely treated its citizens in much the same way that the previous South African regime had treated the black majority, was never going to be an easy decision. Taiwan, reading the tea leaves, made $15m in donations to the ANC’s election coffers in 1994, and dropped millions more on wining and dining comrades in Taipei and elsewhere on the island.

For those African countries that had yet to recognise the PRC, the looming 1997 changeover in Hong Kong (from nominally British to nominally Chinese) proved to be the jumping-off point. Beijing made subtle noises, implying that this ancient trading route into the mainland would no longer be open to countries that did not have official ties with the PRC. The South African Communist Party and other far-left cohorts in the ANC alliance were only too happy to join forces with their ideological brothers. In December 1996 South Africa announced that it would break off ties with Taiwan. By 1998, the split was official—Taiwan had recalled its ambassador and cancelled a raft of aid programmes. It was all very sad.

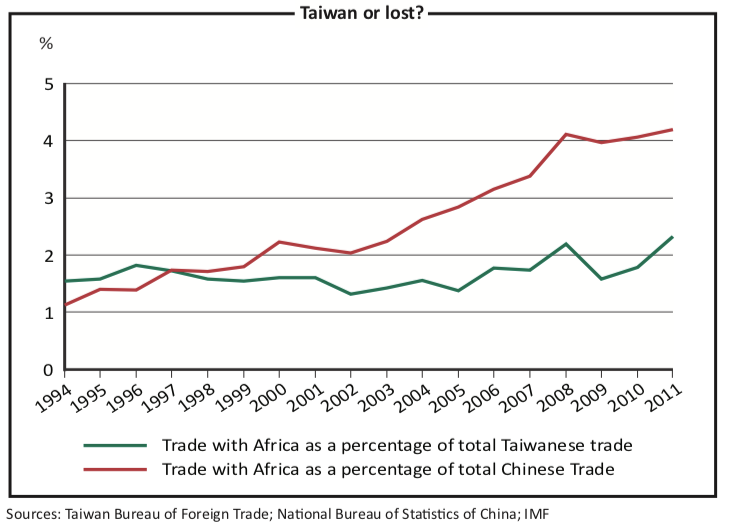

But it was exactly what Beijing wanted. Glancing at an Excel spreadsheet, it can hardly be said that South Africa, or Africa at large, missed the Taiwanese, considering that trade with the mainland hit the stratosphere as the zeroes trucked along. (Taking Africa as a whole, it sat at over $200 billion by the end of 2012, according to Standard Bank.) These days, only 23 states officially recognise the ROC, including the likes of Paraguay, Saint Lucia, Nauru and, least notably, the Holy See.

In 1998 along with losing South Africa, the island lost Guinea-Bissau and the Central African Republic, followed by Liberia in 2003, Senegal in 2005, Chad in 2006 and Malawi in 2008.

The four African countries that still maintain embassies are not exactly heavy hitters: Burkina Faso, the Gambia, São Tomé and Príncipe, and Swaziland. The four are strategically irrelevant (apart from São Tomé’s oil deposits) and confirm Taiwan’s political sidelining.

While the continent’s giants, South Africa and Nigeria, keep trade missions in Taipei, 45 African nations have no diplomatic ties whatsoever. And again, it was not for want of trying: Taipei extended Chad a $125m loan in 1997. São Tomé, on the other hand, was secured with a $30m loan in 1992.

So, what are African countries missing, if anything at all? Chequebook diplomacy, for one thing. And plenty else besides, according to the naturally bullish Africa Taiwan Economic Forum (ATEF). The six African countries formally trading with Taiwan share a population of roughly 230m and private Taiwanese companies trade with 53 African countries. “Taiwan’s trade and investment relationship with Africa is minute when compared with other regions in the world,” states the ATEF’s media release. (Taiwan’s trade with East Asia and the Pacific in 2011, for instance, was $334 billion compared to only $14.7 billion with Africa, according to Taiwan’s Bureau of Foreign Trade.)

The forum’s job is to correct that imbalance by acting as the de facto Taiwanese liaison between African nations and Taipei. “The Africa Taiwan Economic Forum is held jointly by the four embassies and two trade offices of the African countries represented in Taiwan and the Ministry of Foreign Affairs of ROC,” according to the release. If the ATEF’s stated focus is anything to go by, Taiwan views Africa as a potential manufacturing centre—a place where Taiwanese machinery and turn-key plants can be installed and maintained, employing the cheap labour, now dwindling at home, that powered the Asian tigers into middle-income status.

Indeed, Taiwan’s modern history suggests that an authoritarian government can successfully and rapidly industrialise— Taiwan developed in much the same way China did, only 30 years earlier. (Substitute the brutal authoritarianism of the anti-communist Kuomintang for the communists.) Groups like ATEF and the Taiwan African Business Association (TABA) have traditionally expressed interest in Africa as a place to sell heavy equipment and establish factories. In 2007, over 80 Taiwanese companies signed on to TABA.

Like Chinese policymakers on the mainland, Taiwanese officials tend not to see Africa as a basket case, but as a region of almost unlimited potential. “Taiwan companies, however, without official backing like counterparts in China, have to adopt another strategy to tap the African market,” said

Eden Chou, TABA founder and chairman, in 2008. “[In 2007] TABA successfully led three Taiwan trade delegations to different African nations, achieving initial success to build business ties,” Mr Chou said. “But I have been telling Taiwan firms eagerly interested in Africa that the most effective way for Taiwan players is to find suitable partners there, and then educate them in business concepts. In short, we should look at Africa with the view to cultivate the potential market, seeking to achieve mutual success rather than only selling products for short- term business relationships.”

In other words: the long-term trading play. This is more easily said than done. Even in a place like the Gambia, which one would imagine is not the most highly sought- after dance partner, the ROC has been flamboyant in its largesse.

The Gambia ditched the PRC in favour of the ROC in 1995. In the 20 years that the PRC had relations with the West African nation of 1.8m, they built the Independence Stadium, the so-called Friendship Hostel and several health centres. But the Gambia’s President Yahweh Jammeh is a man of capricious tendencies. In swinging away from the PRC, he was able to wrangle considerable concessions from Taipei.

“The two countries will continue to work together in strengthening the cooperation between them,” said Dr Njogu Bah, the Gambia’s minister for presidential affairs, in October 2012. This “strengthening” was surely enhanced by the $300,000 cheque that Taiwan gave to Dr Bah for development purposes—which, it should be noted, pales beside the 16m euros Britain and the European Union donate every year. What Mr Jammeh has perfected is a game the Caribbean islands have been playing for almost 15 years—exploiting Taiwan’s need for UN Security Council votes and regional bases against the looming diplomatic bulldozer in Beijing.

The last trade data available for the Gambia and the PRC dates back to 2001, before the massive rise in Sino-African economic cooperation properly began, according to China’s Ministry of Foreign Affairs. “Major exports from China to Gambia include textiles, Chinese native produce and animal by-products, light industrial and hardware products,” the ministry states, “with textiles and tea accounting for about 90% of the total export volume. In 2001, China’s exports to the Gambia totalled $72.5m. China had no import [sic] from Gambia.” The Gambia, it would seem, is hardly a trading prize.

The same cannot be said for Nigeria or other sizeable African countries. In this, it helps to acknowledge the softening of positions between the PRC and the ROC when it comes to trade expansion, especially in the developing world. There is considerable fluidity between the mainland and Taipei, despite varying degrees of sabre rattling. And here’s why: Taiwan is ranked 13th in the 2010–2011 Global Competitiveness Report of the World Economic Forum (WEF). Sub-categories of the WEF report show Taiwan at 7th place in innovation, 1st in world patent productivity, 3rd in cluster development, 7th in government procurement of high-tech products, and 8th in abundant supply of scientists and engineers. Also, in 2010 Business Environment Risk Intelligence, a US risk analysis company, ranked Taiwan 4th in “profit opportunity recommendation”, out of roughly 80 countries.

Companies from the mainland are only too happy to provide the raw materials and labour to power Taiwan’s burgeoning knowledge economy. According to a government-backed Taiwan trade institution, “the signing of the Economic Co- operation Framework Agreement between Taiwan and China last June has paved the way for more trade pacts between Taiwan and other economies in the years to come. Preferential trade agreements will help Taiwan link up with the whole Asia-Pacific region, thus strengthening its position as a global distribution hub.”

Taiwan has been stumping all across Africa, including Mozambique, Cameroon and Nigeria, to establish relationships—usually taking a business-to-business stance. Even in South Africa—or, rather, especially in South Africa—while business is not exactly booming, the relationship does represent a diversified trading to-and-fro. According to South Africa’s Department of International Relations and Co-operation, South Africa’s main exports to Taiwan include iron ore, steel, machinery, aluminium, motor vehicles and parts, coal, wood and wood pulp, copper, precious stones, metal and gold, granite, organic chemicals, wool, tobacco, corn starch, preserved food and fruit juices. Taiwan’s main exports to South Africa include computer machinery, bicycles, motorbike and automobile parts, plastic resin, yarn and fabric, iron/steel products, toys, sports equipment, hand tools, rubber and optical goods.

That said, the numbers are hardly anything to write home about. According to Taiwan’s Bureau of Foreign Trade, in 2011 Taiwan conducted the most business with Angola, China’s top oil supplier in Africa, which ranked as Taiwan’s 20th highest trade partner ($6.1 billion or 0.97% of Taiwan’s total trade) and came above South Africa, which was ranked 29th ($3 billion or 0.39%). Swaziland was the highest- ranking Taiwan-recognising state with a total trade volume of $17.7m (0.003% of total trade). Overall trade with Taiwan’s African allies amounted to just over $34m in 2011.

But we live and work in a global economy, and the ROC and PRC are increasingly tethered economically. Taiwan and Africa have not yet properly said their goodbyes, and are unlikely ever to do so.