To bypass the Democratic Republic of Congo’s hopeless government, a mining company built its own road

by Kevin Bloom

In the north-eastern Democratic Republic of Congo (DRC), where the country’s remote bush cuts a corner with South Sudan and Uganda, mining company Randgold’s managers recently took it upon themselves to do President Joseph Kabila’s work. The “elephant deposit” the company had acquired in 2009 from Moto Gold, at a reported cost of half a billion dollars, had come with much promise but little infrastructure.

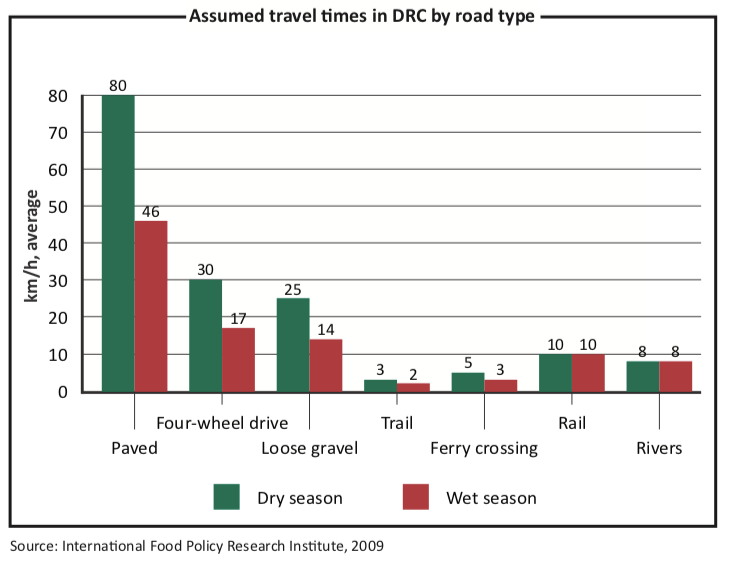

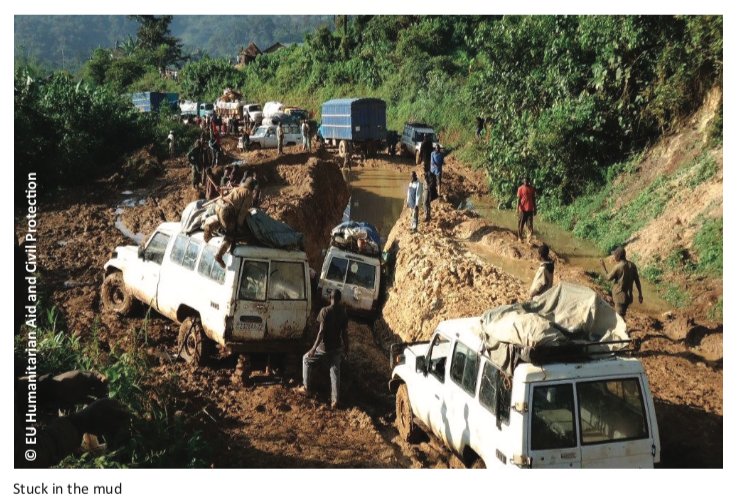

Initially, Randgold was flying in heavy machinery on C-130 transport planes, and in the dry season using six-by-six cargo trucks to haul equipment across from the Ugandan border. Yet even for these monsters, the overland trip could take up to a week—less robust vehicles were routinely completing the 180km journey in more than a month. So Randgold decided to give the DRC government the gift of a new gravel motorway.

“We don’t mind paying for it,” said Louis Watum, the mine’s Congolese-born general manager, in March 2012. “But then tell us how we get our money back. It’s a national road.”

Randgold and their partners in the Kibali mine, AngloGold Ashanti, were offered no tax breaks or incentives on the $8m it cost to grade and pack the artery. But visit the region today and you will see hundreds of low-cost Chinese and Indian 125cc motorcycles, known in this part of the world as wewas, arriving in town after a smooth three-hour ride from the border. For these bike-borne traders and the customers they serve, the Kibali road represents a link with Uganda’s economy and an introduction to the world of modern commerce. Prior to Randgold’s intervention, the market in Watsa, which abuts the Kibali compound, functioned solely on a barter system.

It was never meant to be like this. Going back to the immediate post- independence era, a primary touchstone of the African development agenda has been the establishment of regional economic communities to facilitate intra-continental trade. In such a model, notes the African Development Bank, the creation of shared physical infrastructure has consistently been highlighted as a major imperative in the drive “to address the challenges of small domestic markets, weak productive structures, slow progress on reforms/economic growth, and widespread conflict/political instability.”

By 2009 intra-African trade stood at 10% of the continent’s total trade—versus 22% for Latin America and 50% for Asia—proof enough that the regional strategy has not worked so far. While inter-continental trade, particularly with Asia, has been on the rise, factors such as Africa’s poor road network are responsible for high trade costs between countries. (In a 2010 paper, the United Nations Economic Commission for Africa noted that only 22.7% of all African roads are paved.)

Until Randgold arrived in the north-eastern DRC, the cost of trade with Uganda meant that its citizens were forced to function within an antiquated commercial framework.

“In general, we welcome the Kibali project,” said Father Floribert of the Church of St Barbe, whose parish attends to the spiritual needs of 20,000 locals. “It is good for the welfare of the population. The road has a big influence, and we now have electricity from the mine’s power station.”

What Father Floribert did not say is that aside from the range of currencies that have started to change hands in the market, the road has also brought in prostitution and drugs. Of course, this is often the price of modernisation. When measured against the successes of one local businessman—a Mr Lenguma, who since the opening of the road has accumulated a fleet of 30 buses offering regular transport between the DRC towns of Kisangani and Goma, and Kampala, Uganda’s capital—it is accepted as a worthwhile compromise.

In the broader context of the DRC’s development needs, there is a more pertinent issue than the social ills that come from economic growth: can the Kabila government adequately manage and encourage international investment in infrastructure? Or must these conglomerates continue to accept an unusually high level of risk?

To most interested observers, the answer seems obvious: risk and the DRC are synonymous. The infrastructural deficiencies, however, pose an even greater problem than the ever-present threat of armed conflict: the CIA World Factbook cites a total of 153,497km of road in the country, with only 2,794km paved. The DRC faces what is “probably” the most daunting infrastructure challenge on the continent, according to the World Bank’s March 2010 Africa Infrastructure Country Diagnostic (AICD). Half of the nation’s existing assets are in need of rehabilitation, the report noted, while its vast geography, low population density, extensive forestlands and criss-crossing rivers all act as serious obstacles to development.

“To rebuild the country and catch up with the rest of the developing world,” the report stated, “the DRC needs to spend $5.3 billion a year over the next decade, a sum equivalent to 75% of its 2006 GDP. Of this total, as much as $1.1 billion a year needs to be devoted to maintenance alone. The DRC’s recent infrastructure spending of $700m a year falls far below the level needed to make an impact over the next decade. Significant inefficiencies waste at least $430m each year, but even if these problems were corrected, an infrastructure funding gap of the order of $4 billion a year would remain.”

By “significant inefficiencies”, the AICD authors, Vivien Foster and Daniel Alberto Benitez, may have been referring to—among other things—evidence of large-scale corruption in Beijing’s showcase $6 billion ore-for-infrastructure swap with Kinshasa, a Sino-Congolese joint venture otherwise known as Sicamines.

A commission set up by the DRC’s National Assembly in early 2010 uncovered this graft. It revealed that $23m in signature bonuses had been stolen, part of a $50m package that Chinese companies owed Congo’s mining parastatal Gécamines. That $50m in turn, was part of a $350m fee the Chinese—represented in the deal by China Railway Engineering Corporation (CREC) and Sinohydro—had agreed to give the DRC government on signing. The agreement also called for the government to grant the Chinese parastatals access to concessions holding over 10m tonnes of copper and 600,000 tonnes of cobalt (estimated to be worth $100 billion). In return the Chinese would oversee and provide loan capital for the construction of roads, railways, schools and hospitals.

To fully grasp the potential impact of the Sicamines joint venture, by all accounts the most ambitious and important infrastructure project in the DRC’s post-independence history, it helps to understand the circumstances behind the deal. A superficial reading of the joint venture interprets it as just another demonstration of Beijing’s determination to gain access to Africa’s resources, and this is no doubt true. But there are background subtleties to the negotiations that reveal much about its prospects.

First, as Johanna Jansson observed in an October 2011 research paper for the South African Institute of International Affairs, the state-owned enterprise CREC (not the Chinese government) initiated Sicamines, and only looked at the DRC in the wake of its failure to secure mining concessions in Latin America. Second, after a shaky coalition won Mr Kabila the 2006 legislative elections, it was clear that for him to be re-elected in 2011 he would need to deliver on his promise of a massive public works programme. Third, although the Western donor community, present in large numbers in the Congolese capital and the war-ravaged east, was unable to come up with the funds to assist Kabila—a direct result of the 2008 financial crisis—it quickly became expert at criticising the Chinese intervention from the sidelines.

The Western donors’ major gripe was that the original Sicamines September 2007 memorandum of understanding (MOU) was skewed in favour of the Chinese signatories, whose copper and cobalt concessions were said to be worth much more than the infrastructure projects their loans would finance. Linked to this was the complaint that China’s $9 billion loan, as stipulated by that MOU, was not concessional, i.e. the interest rates were not low enough and the repayment periods not long enough to qualify for the favourable terms traditionally granted to poorer countries. In the context of the country’s sizeable external debt—which was sitting at the time at $13.1 billion (or more than 100% of the DRC’s 2008 $11.7 billion GDP)—it was argued that the clause requiring the Congolese government to guarantee repayment of the loan through investment in the mining operation was unreasonable. No other international player in the DRC’s mining sector, said the critics, had such a government guarantee.

As far as the West was concerned, it therefore appeared that Mr Kabila could not fully mitigate the risk of investment in the DRC—even when he wanted to. During a May 2009 trip to Kinshasa, the DRC’s capital, Dominique Strauss-Kahn, then head of the nternational Monetary Fund, convinced the president to request changes to the MOU. A redrafted agreement, the final version of which was signed in October 2009, dropped the Congolese state guarantee on the mining investment, instituted more favourable repayment terms, and reduced the deal’s total worth from $9 billion to $6 billion.

Henceforth, when it came to Sicamines, there would be only two remaining issues over which Western observers could protest: the above-mentioned evidence of large-scale corruption and the deal’s apparent inequitable nature. Are these grievances equally legitimate? Some experts think not. Whereas the corruption probe provides no room for debate or justification, the deal’s fairness remains murky. The allegation that the Sicamines deal is heavily skewed in favour of the Chinese “fails to consider that once the loans for infrastructure refurbishment are fully reimbursed, the Sicamines joint venture will start paying taxes in accordance with the mining code, just like other large-scale mining ventures operating in the country,” Ms Jansson wrote. “The agreement would thus only be skewed if value for ‘money’ (mining titles) is not ensured in the pricing and implementation of the infrastructure projects. However, even in this event, the agreement would only be skewed until the loans for infrastructure refurbishment are reimbursed and Sicamines enters the regular tax regime. To be exact, Sicamines would only be different from other mining ventures until this time.”

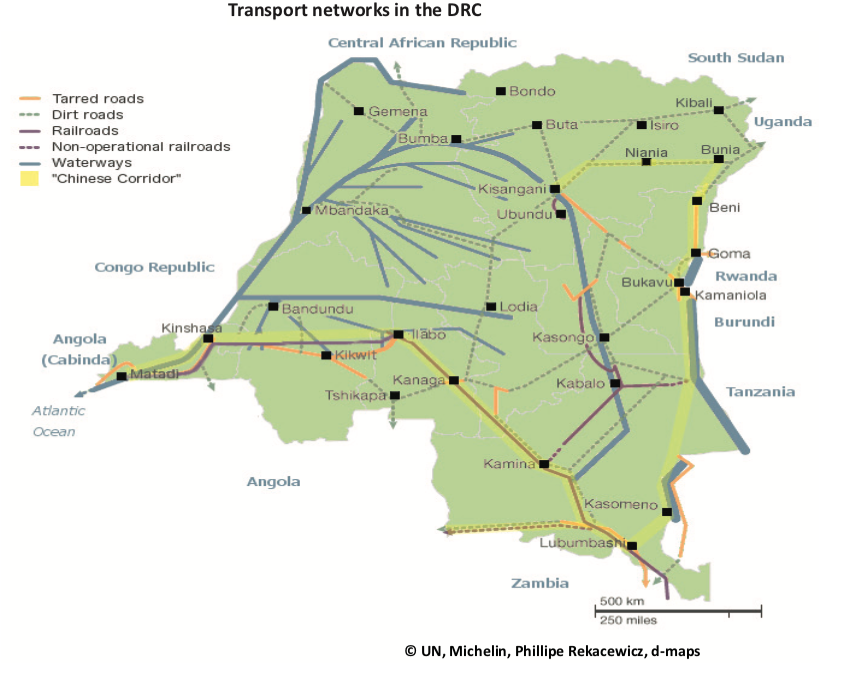

As of June 2011, according to Ms Jansson, the road between Beni and Niania in North Kivu province, at a reported cost of $57m, was the only infrastructure project financed through Sicamines that had been completed. My own March 2012 visit to the DRC confirmed that Boulevard Triomphale, Boulevard Sendwe, and phase one of Boulevard du 30 juin in Kinshasa had either been completed or were about to be (although no costs on any of these projects were forthcoming).

Clearly, relative to the national road and rail network the Kabila government plans to build in the DRC, the impact of the Sicamines initiative has so far been miniscule. Look at any map of the venture and you will see a so-called “Chinese corridor” that links this vast country’s nodes. There are plans for a road connecting Kinshasa to the port of Matadi on the Atlantic coast (a rail line already services this route). Going east from Kinshasa, a road and rail system stretches to Ilabo, then turns south-east towards Lubumbashi and the copper-rich Katanga province (again, an existing rail line runs from Ilabo to Lubumbashi, and beyond into Zambia). From the south-east corner, another major highway runs north through the beleaguered Kivu provinces, then into Orientale province and the border with Uganda (to presumably hook up with the road that Randgold recently built). A final stretch runs west again to Kisangani.

In short, thousands of kilometres of highways that are yet to be built. Ms Jansson’s research shows that the largest Sicamines project currently underway is the stretch from Lubumbashi to Kasomeno in Katanga, a $138m CREC assignment that runs for under 150km. Other than a 15km section in North Kivu, and another short run from Bukavu to Kamaniola in South Kivu, all the Sinohydro assignments still on the books are in Kinshasa. To put that in perspective, Matadi to Lubumbashi is 2,700km by road.

Still, it is important to remember that the mining part of the Sicamines joint venture is only due to kick-off in 2014, with full capacity expected in 2016. “If the deal had to fall apart now,” Kimbembe Mazunga, Mr Kabila’s adviser on infrastructure, said in March 2012, “we will have gotten $500m in infrastructure and the Chinese will have gotten nothing.”

While Mr Mazunga’s sum includes the Central Hospital in Kinshasa, built by Sinohydro at a cost of $200m, it may be slightly exaggerated. Nevertheless, it is unlikely the Chinese will pull out and let their investment go to waste. As with Randgold and every other mining conglomerate operating in the DRC, the Sicamines risk is firmly on the investor’s side. As with Randgold, which believes it is sitting on 40m ounces of gold—and is on track to start mining in 2013—the Chinese intend to stay and build infrastructure until the price of that risk is returned a hundred-fold.

By implication, and assuming governance on issues such as anti-corruption and taxation is even mildly effective, success for Randgold and Sicamines would translate into success for the region. New roads would significantly bring down the cost of trade and markets that have been functioning for decades on a barter system would be introduced to the modern age.